670 credit score auto loan interest rate 229095-What kind of interest rate can i get on a car loan with a 670 credit score

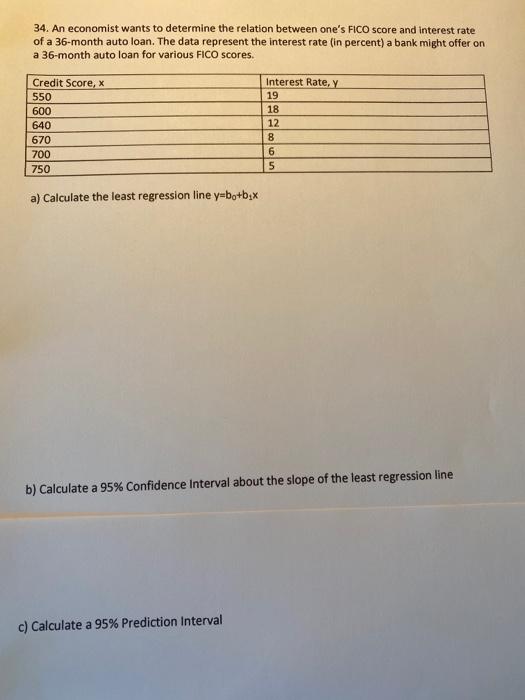

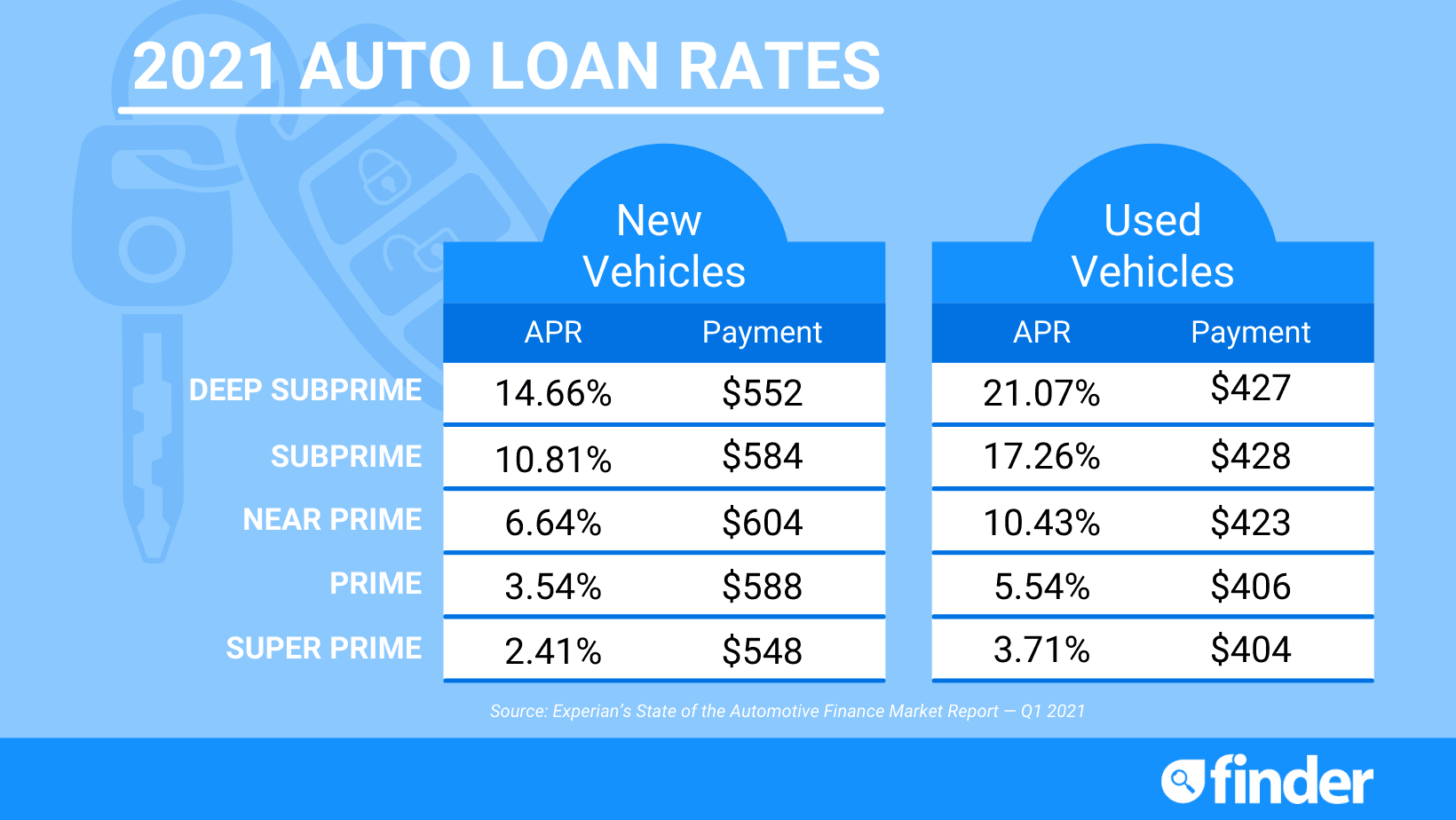

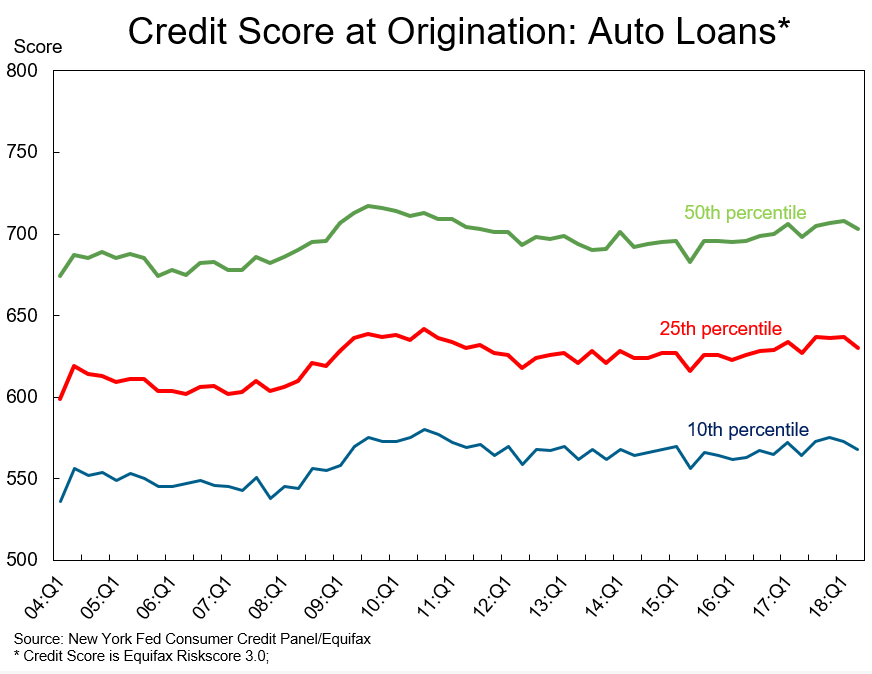

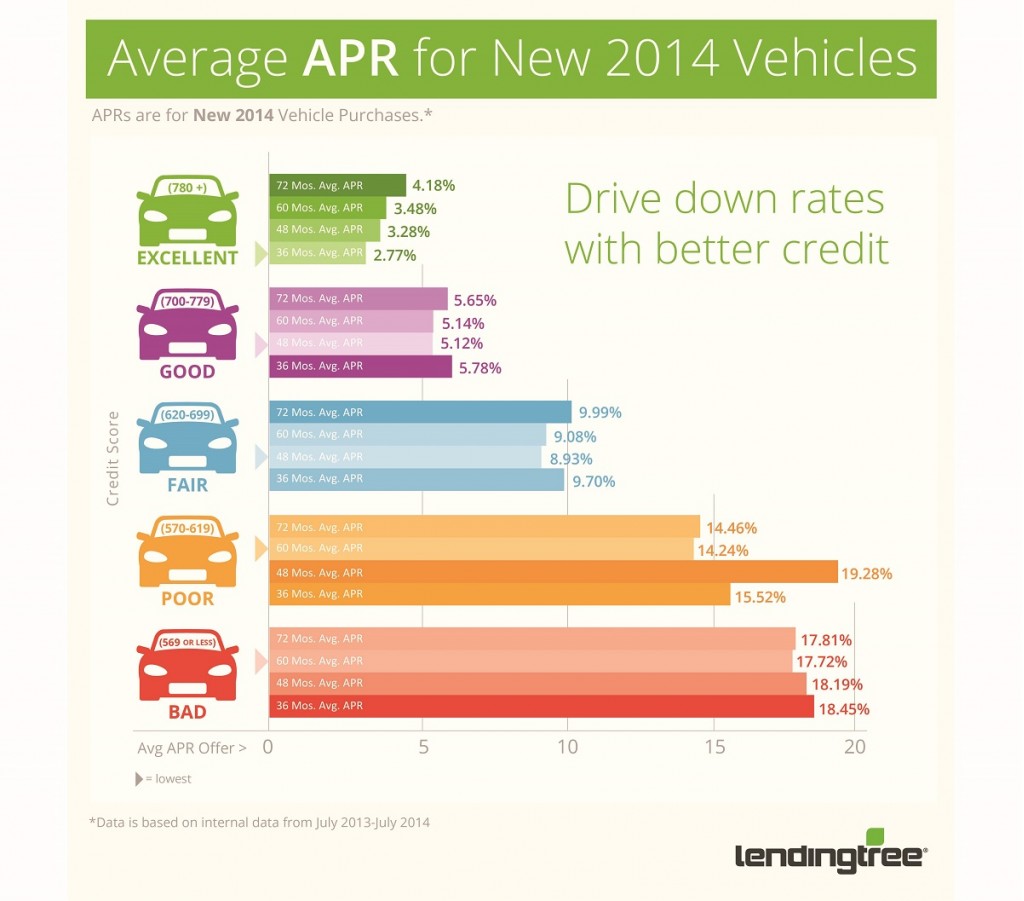

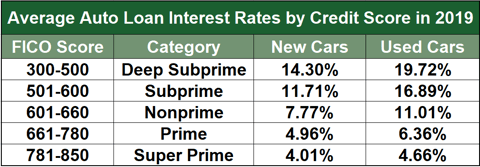

Individuals with a 675 FICO credit score pay a normal 676% interest rate for a 60month new auto loan beginning in August 17, while individuals with low FICO scores (6659) were charged 94% in interest over a similar termJun 25, 19 · Looking at the chart above, a good interest rate is between 317% and 1376% when you take your credit score into account Choose the rate you're aiming for and be ready to negotiate if you're offered a higher rateMar 29, 21 · Mar 29, 21 There is no specific minimum credit score required to buy a car But the higher your credit score is, the more options you'll have and the more you'll save on auto loan interest For example, newcar buyers had an average credit score of 714 as of the first quarter of 17, according to the latest data from Experian

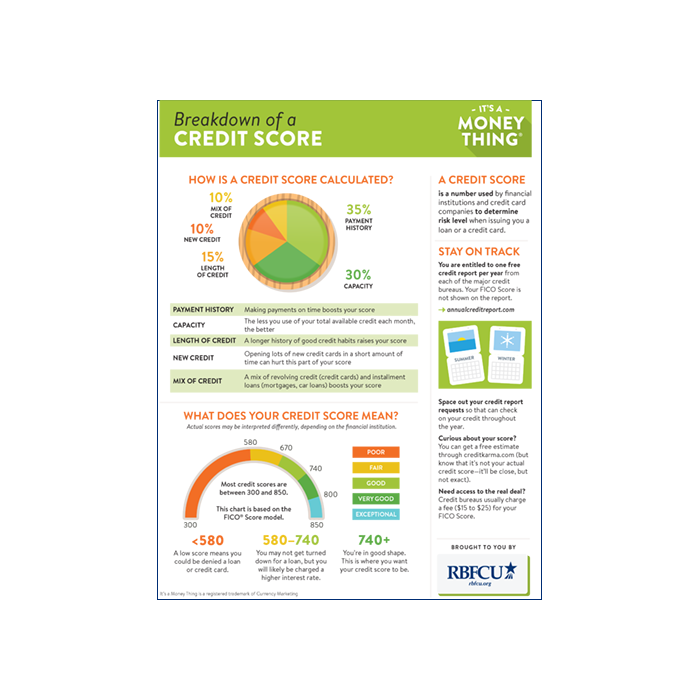

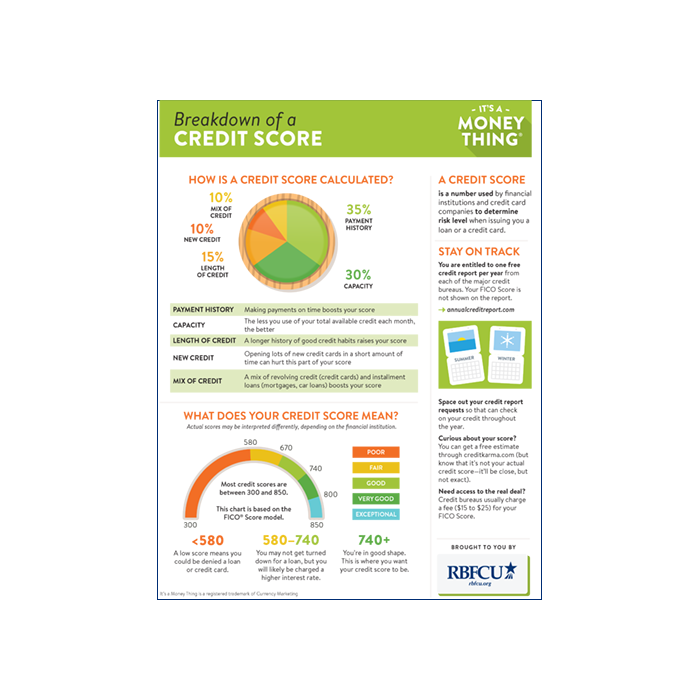

Breakdown Of A Credit Score Rbfcu Credit Union

What kind of interest rate can i get on a car loan with a 670 credit score

What kind of interest rate can i get on a car loan with a 670 credit score-Nov 03, · Your actual rate depends upon credit score, loan amount, loan term, and credit usage and history, and will be agreed upon between you and the lender For example, you could receive a loan of $6,000 with an interest rate of 799% and aWhat Are The Best 680 credit score car loan interest rates?

673 Credit Score Is It Good Or Bad

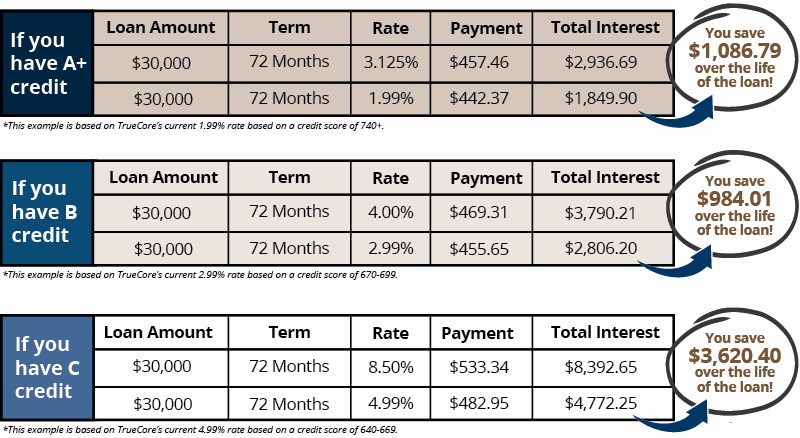

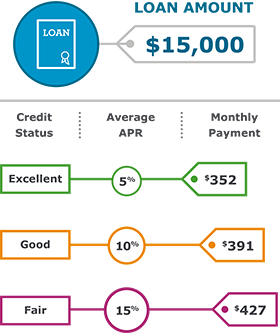

Let's begin by clearing the air, only people with Excellent credit will get the famously advertised 1 or 2 percent interest rates You are in a good position to qualify for a prime car, motorcycle , truck loan or boat loans with a reasonable APR from traditional and online lendersFeb 12, 19 · On the other hand, at a 702 percent interest rate, that same car will cost you $17,0 Now, if you were able to improve your credit score to Very Good (495 percent), that car would cost $16,964 That is a savings of right around $4,000 between Fair and Very Good Average Interest Rate Ranges Rates Divided by Credit Score RangeJun 24, 21 · FICO® score APR Monthly payment * ;

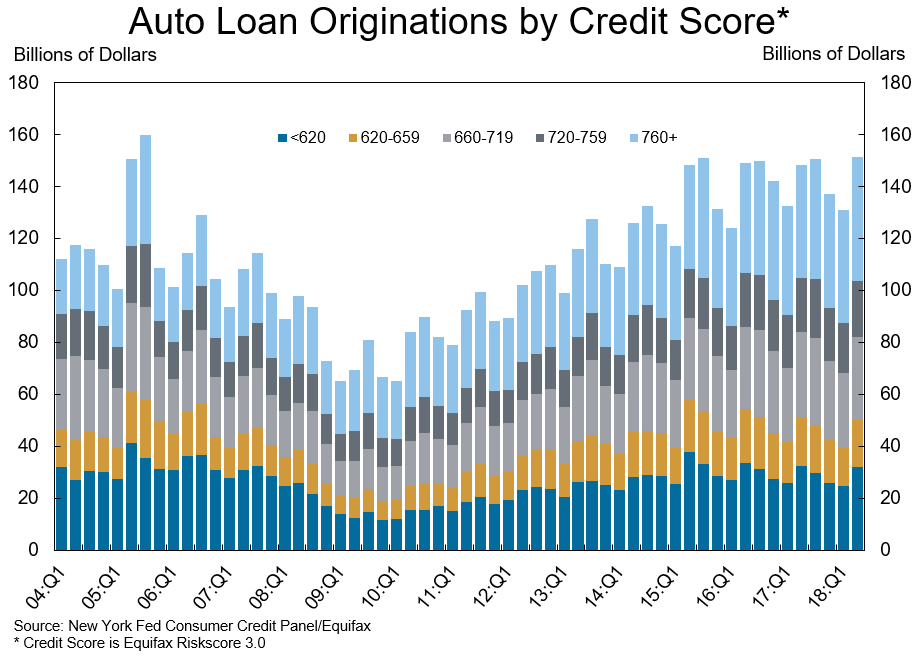

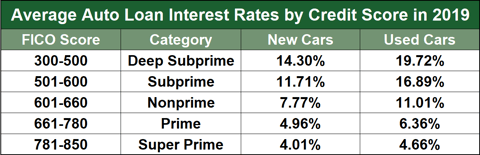

Aug 16, · Experian's quarterly State of the Automotive Finance Market takes a look at the average auto loan interest rate paid by borrowers whose scores are in various credit score ranges As of the first quarter of , borrowers with the highest credit scores were, on average, nabbing interest rates on new cars below 4%Oct 03, 10 · They came back with an offer of 13 14% interest depending on the term of the loan My credit score is 670 I had another dealer ran my SS# and he thought I should be able to get around 6% with that score Of course, he didn't do the full applicationMay 28, 21 · In return, lenders expect compensation for extra risk in the form of higher interest rates This chart, based on APRs for closed auto loans by credit score on the LendingTree loan platform in , illustrates how your credit score can affect what you pay to finance your car Credit Score Average APR 7 or higher 549%

All loan payment amounts are based on a personal loan APR interest rate of 995% for fair credit borrowers with a credit score of 580 to 6 The loan terms included in this chart are for 3 years (36 months), 5 years (60 months), and 7 years (84 months) However, speak to your lender about additional loan optionsAll loan payment amounts are based on a new car loan APR interest rate of 1068% for sub prime borrowers with a credit score of 500 to 599 The loan terms included in this chart are for 3 years (36 months), 5 years (60 months), and 7 years (84 months) However, speak to your lender about additional loan options for new, used, or refinancingCons Minimum credit score not disclosed (reported to be 660)

Everything You Need To Know About Credit Scores Makingcents Navy Federal Credit Union

Breakdown Of A Credit Score Rbfcu Credit Union

Jun 15, 21 · For example, DCU Credit Union – which lends nationally – is offering auto loans as low as 274% APR The minimum credit score they'll accept is 650, which is actually a little bit below the 670 to 739 range normally considered to be good creditStandard Definition Yes – A lot of people think good credit starts at a score of 660 and ends at a score of 719 WalletHub's Rating No – Based on the rate at which people with 670 credit scores get approved for credit cards that require "good credit" or better, we believe you actually need a credit score of to have good creditJul 01, 21 · A car loan may seem impossible to secure without an established credit history While it is difficult it is not entirely possible, and we will walk you through what you need to know about getting a car loan with no credit Option 1 Finance through Your Bank or Credit Union

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

Dec 14, · Auto Loan You can find a car loan and get a vehicle with almost any credit score, but your odds of being rejected or receiving a higher interest rate are much higher if you have a poor credit score Applicants with a credit score of over 700 are more likely to qualify for auto loans with low interest ratesMay 22, 21 · Experian reported that for the fourth quarter of , the average newcar loan rate for scores of at least 661 was only about 1 percentage point higher than148% There are less lenders to work with in this credit range, which does not provide many options Not only that, but the auto loan interest rates that are seen can be upwards towards the 16% or more mark for those that are purchasing an auto with this credit rating

Is A 700 Credit Score Good Or Bad Student Loan Hero

Learn What Is A Good Credit Score In Canada Good Credit Explained

May 05, · A 650 credit score auto loan interest rate will vary pending on your lender, your downpayment, your DTI, and the loan terms The longer your terms of the loan (36 to 60 months) the higher your rates The commercials you see with low APR percentage rates are for attention grabbers and is most likely possible for borrowers with 750 or higherMay 15, 17 · A target credit score of 660 or above should get you a car loan with an interest rate around 6% or below That data comes from a June report from credit bureau Experian It also found that676% Interest rate on car loan with 673 credit score can go anywhere from 8% to 12%, but

Best Personal Loans For Fair Credit Credit Score 600 669

What Is Considered A Bad Credit Score Sofi

Apr 30, 21 · Your actual rate depends upon credit score, loan amount, loan term, and credit usage and history, and will be agreed upon between you and the lender For example, you could receive a loan of $6,000 with an interest rate of 799% and a6 rows · Jun 01, 21 · Prime (661 to 780) 354% $671 Super Prime (781 to 850) 241% $656 With the interest rate asJun 25, 21 · Mortgage rates for credit score 670 on Lender411 for 30year fixedrate mortgages are at 299% That increased from 299% to 299% The 15year fixed rates are now at 256% The 5/1 ARM mortgage for 670 FICO is now at 456%

What Is A 600 Credit Score Credit Sesame

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

Aug 23, · 1 Check your credit score Powersport loans often require higher credit scores than car loans A FICO score of 719 to 690 is considered good, but 7 and above is considered great Generally, the higher your credit score, the greater your chance of getting approved for a powersport loan with a low APR6 rows · Individuals with a 670 FICO credit score pay a normal 676% interest rate for a 60month newMost auto lenders will lend to someone with a 670 score However, if you want to ensure you qualify for the best interest rates, you will want to continue improving your credit score See also 8 Best Auto Loans for Good Credit How to Improve a 670 Credit Score Credit scores in the Good range

650 Credit Score Auto Loan Interest Rate What Can You Expect Is 650 A Good Credit Score

Oct 31, 19 · LightStream offers installment loans with very low interest rates for people with goodtoexcellent credit Here is a quick overview of LightStream loans Pros Low APRs 249% 1999%;Feb 28, 17 · 44% Individuals with a 670 FICO ® Score have credit portfolios that include auto loan and 27% have a mortgage loan Recent applications When you apply for a loan or credit card, you trigger a process known as a hard inquiry, in which the lender requests your credit score (and often your credit report as well)FHA Loan with 670 Credit Score FHA loans only require that you have a 580 credit score, so with a 670 FICO, you can definitely meet the credit score requirements With a 670 credit score, you should also be offered a better interest rate than with a FICO score

What Credit Score Is Needed For A Car

Dnhg0fkecrholm

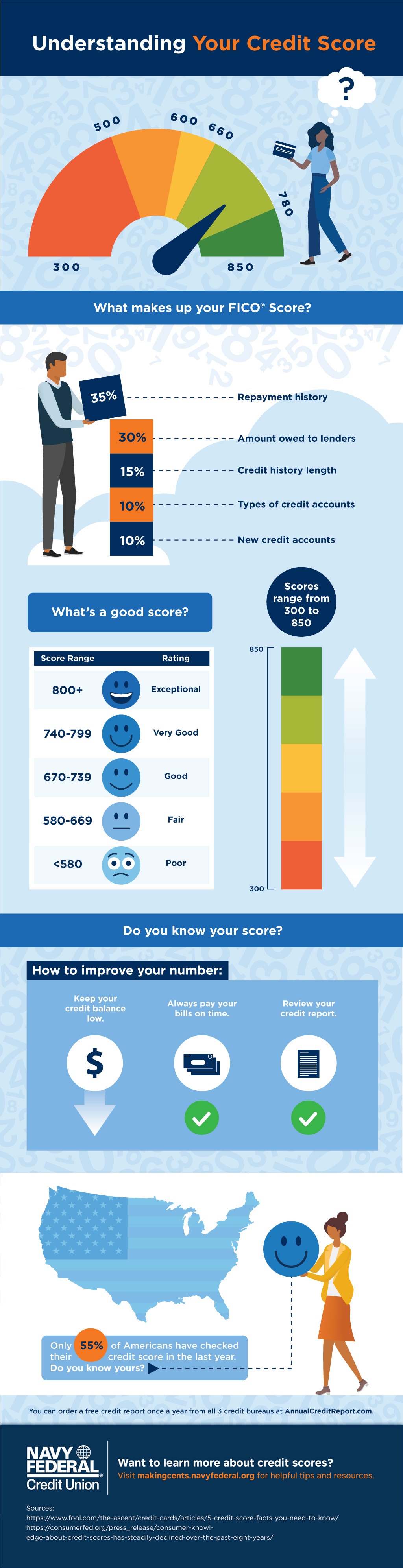

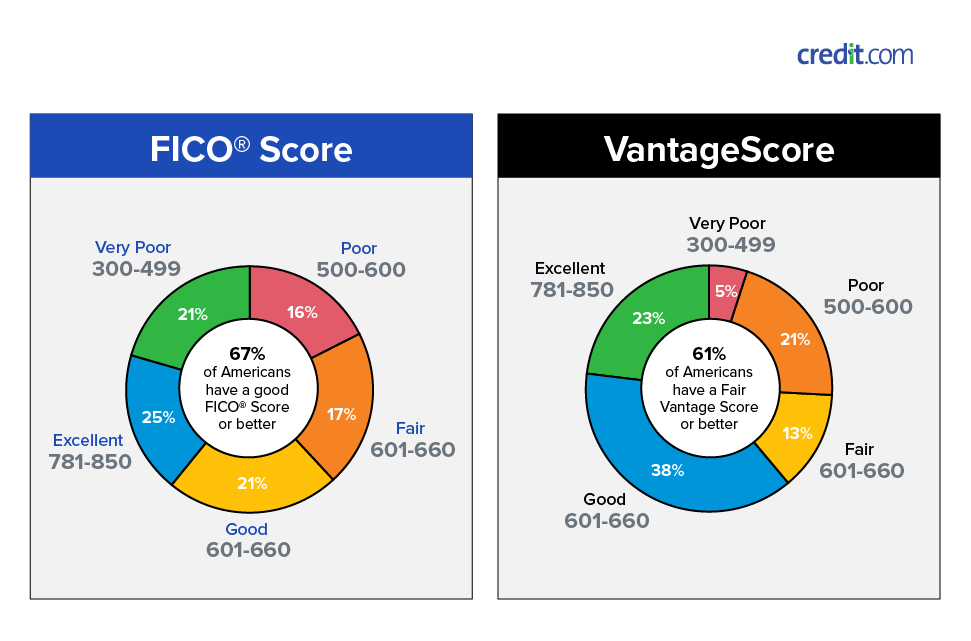

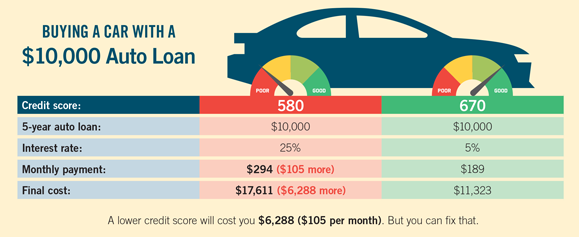

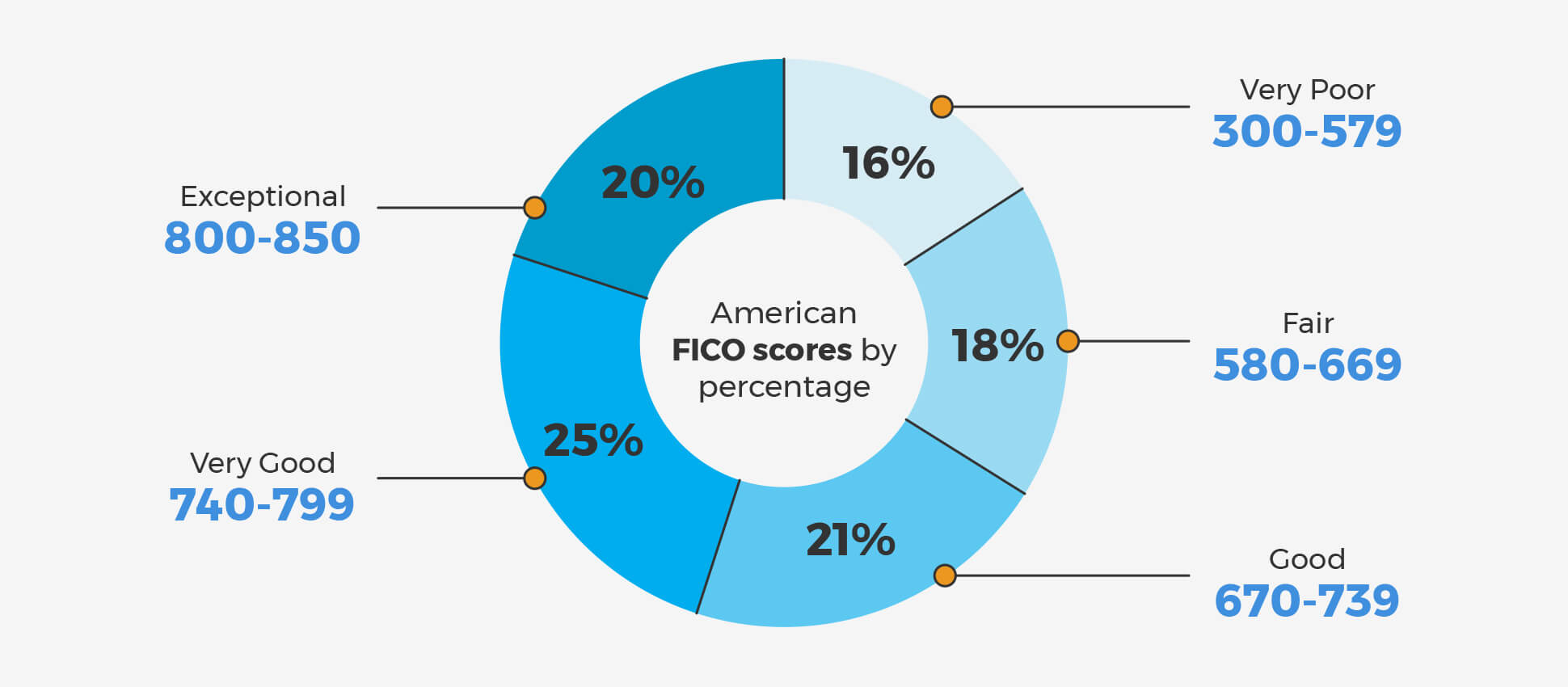

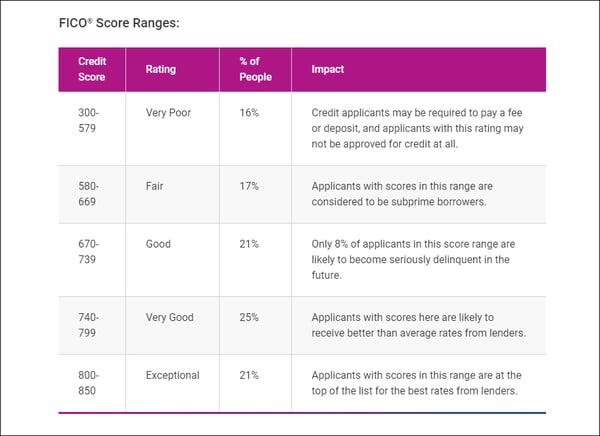

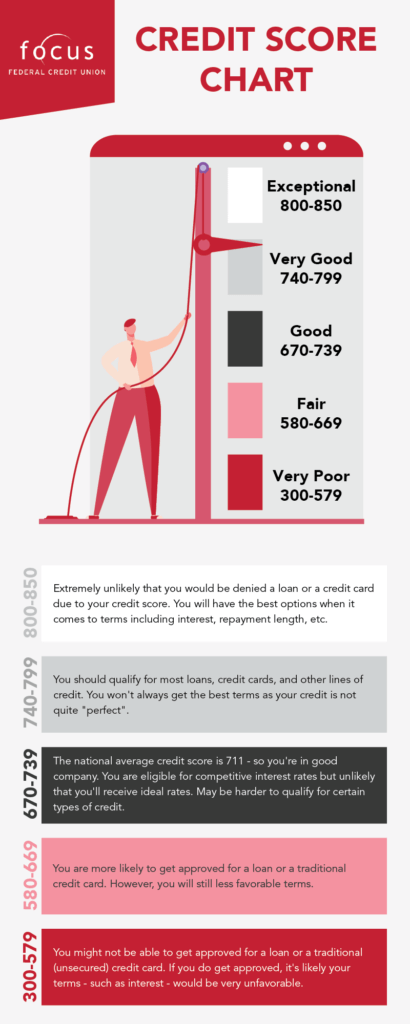

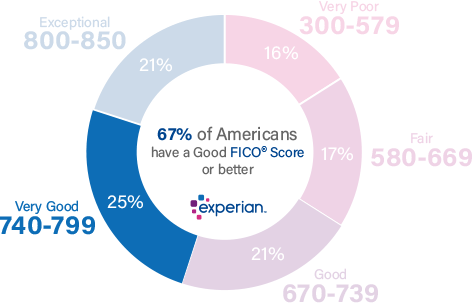

May 21, 21 · A good credit score gets approval for attractive rates and terms for loans For FICO score, a credit score between 670 and 739 is generally considered "good"Sep 10, · The higher interest rate you'll pay clearly demonstrates the importance of doing what you can to improve your credit score If you raise your score from 600 to 700, you'd be eligible for a car loan at a significantly lower rate with a good credit score — about 5% on a new car and 63% on a used oneYour score falls within the range of scores, from 670 to 739, which are considered Good The average US FICO ® Score, 704, falls within the Good rangeLenders view consumers with scores in the good range as "acceptable" borrowers, and may offer them a variety of credit products, though not necessarily at the lowestavailable interest rates

How To Raise Your Bad Credit Score Above 700 Mybanktracker

Best Auto Loan Rates With A Credit Score Of 700 To 709

Aug 22, · Generally speaking, the "right" credit score depends on the lender you're interested in However, many car loan lenders consider a credit score of 630 to be the threshold for potential approval You may qualify for an auto loan with a lower score, though your lender may extend higher interest rates or weaker terms for your loanThe size of your monthly payment depends on loan amount, loan term, and interest rate Loan amount equals vehicle purchase price minus down payment, rebate (if applicable), and net tradein value Net tradein value is equal to the vehicle tradeinScores sourced from Nerd Wallet site and are accurate as of 7/08/19 All loan payment amounts are based on a new car loan APR interest rate of 456% for prime borrowers with a credit score of 660 to 780 The loan terms included in this chart are for 3 years (36 months), 5 years (60 months), and 7 years (84 months)

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

How To Get A Low Interest Car Loan

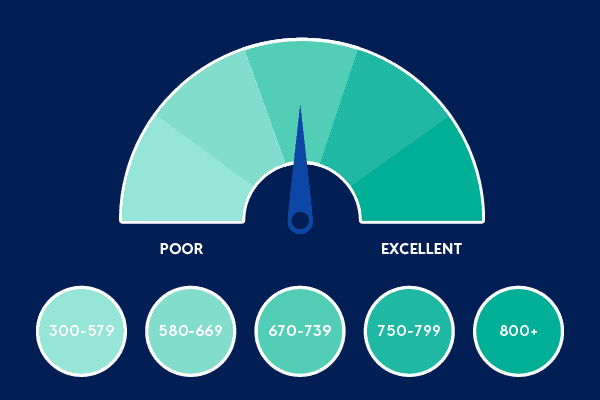

Jul 03, 21 · 580 to 669 = fair credit score 670 to 739 = good credit score 740 to 799 = very good credit score 800 to 850 = excellent credit score The average credit score needed to buy a car A score of 670 and above, categorized good to excellent, is required to buy a car Interest rates will normally be under 6% if you are categorized under this groupMay 28, 21 · Best VA Loan Rates with 700 to 710 Credit Score As you can tell from the chart above, the best VA loan rates by credit score are grouped by tiers When you have a lower credit score such as 601 or 622, the APR VA mortgage interest rate is much higher than if you have a credit score of 700, 705 or 710May 10, 21 · Loan Amount N/A APR Range Varies Term 24 – 72 months SimpleScore N/A / 50 close SimpleScore Auto Credit Express N/A Rates N/A Loan Size N/A Used Car Rate

Today S Mortgage Interest Rates Jan 7 21 Forbes Advisor

Quick Answer Can I Get A Car Loan With A 600 Credit Score Autoacservice

Yes, you can get a car loan with a 670credit score Since this is considered to be a "fair" credit score, youFeb 19, 19 · Credit Score requirements for your auto loan in 19 The average credit score for a newcar loan in 17 was 721 and 641 for a used car loan However, the range of credit scores among people who purchased a car in 17 runs the gamut, so you can still get a loan with a lower than average score — but the terms might not be as greatHigh loan amounts $5,000 $100,000;

What Is A Good Credit Score Forbes Advisor

Fico Score America First Credit Union

The average auto loan interest rate with a 700credit score is 468% for a new vehicle Used cars have a slightly higher interest rate because the resale value is harder to predict Can I get a car loan with a 670 credit score?Apr 13, 21 · That's $3,574 in interest over a 60month car loan If you have a 675 FICO® Score Your payment would likely be closer to $610No origination or prepayment fees;

What Is A 680 Credit Score Credit Sesame

1

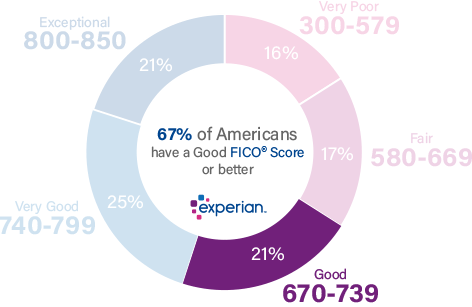

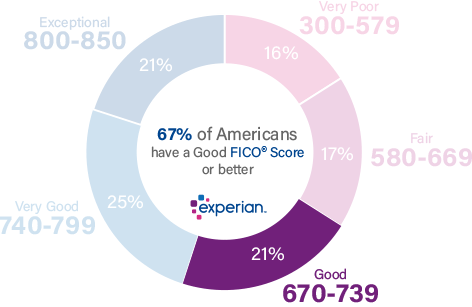

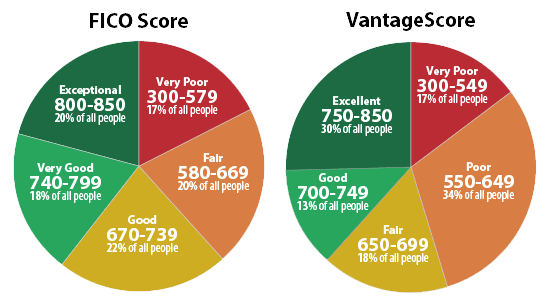

Mar 01, 21 · A score in this range is viewed as being very good Borrowers in this category qualify for low interest rates, but not as low as those for borrowers with excellent credit Roughly 25 percent of all borrowers have a FICO score within this range 670 – 739 Roughly 21 percent of borrowers have a score that falls within this rangeJan 27, · Subprime borrowers, on the other hand, and those with lower credit scores don't fare as well Buyers with a credit score of between 5005, for example, are looking at interest rates as high as 167% and a monthly car payment of $494 With the higher credit score, you'll also save $7,312 in interest paid over the life of the loanFeb 24, · In general, a credit score above 670 will allow potential mortgage borrowers access to prime or favorable interest rates on their loan 2 Scores below 6 are considered to be subprime, and

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

Aug 12, 19 · In general, though, the higher your credit score, the better your chances of scoring a low interest rate and less restrictive loan terms For example, if you have a good credit score, you may be able to finance $30,000 for a new vehicle with a 399% APR over 60 monthsMay 15, 19 · According to a 17 report from VantageScore Solutions and financial consulting firm Oliver Wyman, auto lenders used a VantageScore credit score for more than 70% of new auto loan and lease decisions from July 16 to June 17Aug 02, · A low credit score means you typically won't qualify for the catchy zeropercent offers highlighted in ads for new cars, and it means that you could pay hundreds or even thousands of dollars more in interest over the life of the loan Excellent This category includes 21 percent of borrowers, and gets the best rates

What Is The Average Auto Loan Interest Rate Depends On Credit Score

Best Auto Loan Rates With A Credit Score Of 700 To 709

Can I get an auto loan with a 670 credit score?4848% $264 7739 5223% $275 6473% $315 7848% $362 9348% $415 6639 1037 /5 average rating among users;

1

How A Bad Credit Score Affects Your Auto Loan Rate International Autosource

Mar 16, 21 · Your actual rate depends upon credit score, loan amount, loan term, and credit usage and history, and will be agreed upon between you and the lender For example, you could receive a loan of $6,000 with an interest rate of 799% and a

Bad Credit Car Loan Calculator

Best Personal Loans For Good Credit Credit Score 670 739

Thanks To The Fed Auto Loan Rates Are The Lowest In Years

:max_bytes(150000):strip_icc()/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

Auto Loans At Truecore

657 Credit Score Is It Good Or Bad

What Credit Score Is Needed For A Car

What Is A Good Credit Score Forbes Advisor

Why You Need A 740 Credit Score For Your Auto And Mortgage Loan Applications Gobankingrates

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

600 Credit Score Car Loans 21 Badcredit Org

New Car Loan Rates By Credit Score Credit Score Chart For Auto Loan News Word Based On Experian Data Insider Calculated The Difference Between New And

What Is An Excellent Credit Score These Days Hbi Blog

What Are The Different Credit Score Ranges Experian

/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png)

How A Credit Score Influences Your Interest Rate

Can I Get A Car With A 500 Credit Score Suburban Auto Finance

Car Shopping And Car Culture Web2carz Mobile

:max_bytes(150000):strip_icc()/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)

Fico Score Definition

Solved 34 An Economist Wants To Determine The Relation B Chegg Com

What Is A Good Credit Score Nextadvisor With Time

Chase Auto Loan Review For 21 U S News World Report

Wonder What A Credit Score Is We Explain Comparecards

What Is A Fico Credit Score And What Impacts It

670 Credit Score Is It Good Or Bad What Does It Mean In 21

What Is A Good Credit Score Credit Com

4 Ways To Improve Your Credit Score Wikihow

What Credit Score Do You Need For A Car Loan News Cars Com

673 Credit Score Is It Good Or Bad

1

Current Auto Loan Rates Best Lenders Of July 21 Finder

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

Auto Buyers Credit Repair Fix My Credit Credit Expert Llc

670 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

How To Get A Loan From A Bank Wells Fargo

Average Auto Loan Rates Credit Repair

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

How To Build Your Credit Before First Auto Loan Fox Business

Credit Cards Loans For Credit Score 600 650 Mybanktracker

2

670 Credit Score What Does It Mean Credit Karma

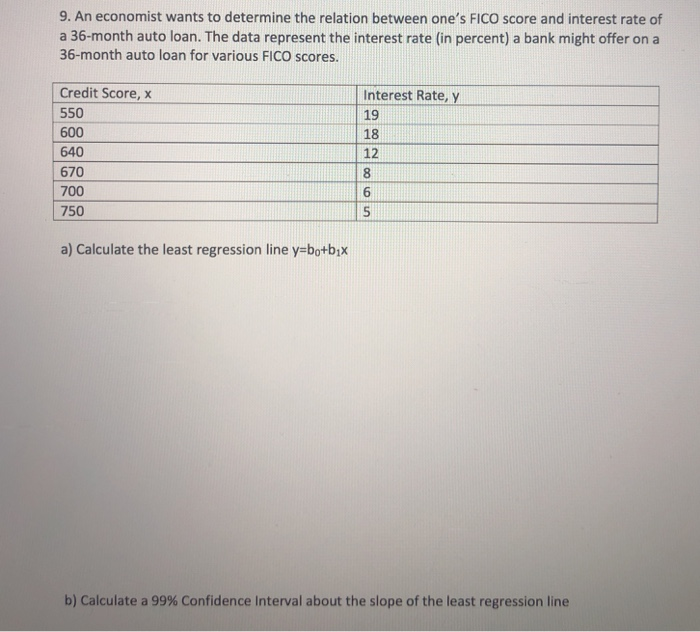

Solved 9 An Economist Wants To Determine The Relation Be Chegg Com

What Is A Good Credit Score To Buy A Car Mintlife Blog

What Credit Score Do I Need For A Car Loan The Ascent

/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

Bad Credit Car Loan Calculator

Check Out Average Auto Loan Rates According To Credit Score Roadloans

Understanding Credit Score Algorithms Amplify Credit Union

Bad Credit Car Loan Calculator

Search Q New Car Apr Rates Tbm Isch

What Is A Good Credit Score Self

What Is A Fair Credit Score Credit Com

How To Find The Best Auto Loan Rates 21

668 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

How To Get A Lower Interest Rate On Your Next Car Credit Absolute

Why Your Credit Score Matters When Getting An Auto Loan

Auto Loan Hiep S Finance

What Credit Score Do You Need To Buy A Car Auto Com

Your Credit Score Your Auto Loan 4 Things You Can Do To Get A Better Interest Rate

Best Auto Loan Rates With A Credit Score Of 670 To 679 Credit Knocks

What Is A Good Credit Score About 700 Out Of 850 Is Considered Good

Car Loan Interest Rates With 670 Credit Score In 21

Credit Score Chart Focus Federal Credit Union

4 Easy Steps To Get A Car Loan At Best Interest Rates Read This Infographic To Know The 4 Easy Steps To Get Aca Car Loan Calculator Car Loans Loan Calculator

600 Credit Score Car Loans 21 Badcredit Org

How To Raise Your Credit Score By 100 Points In 45 Days

Average Auto Loan Interest Rates Facts Figures Valuepenguin

790 Credit Score Is It Good Or Bad

10 Bad Credit Car Loans 21 Badcredit Org

Ideal Credit Score To Buy A Car And Get An Auto Loan Supermoney

How To Get A Car Loan Money Com

What Is A Good Credit Score Nerdwallet

Will Getting A Car Loan Improve Your Credit Score Heck No

Best Personal Loans For Good Credit Credit Score 670 739

What Is A 586 Credit Score Credit Sesame

コメント

コメントを投稿